Accident, Critical Illness & Hospital

Benefits Enrollment & Changes

You may enroll in benefits during your first 31 days of full-time employment. However, once elections have been submitted, you are unable to make changes even if you are still within your 31-day enrollment window. You may also make changes to current coverage within 31 days of the date you experience a qualified change in status or change coverage during the annual open enrollment period. Open Enrollment is typically held November 1 – 15 each year, and elections made during this period become effective January 1 of the next calendar year.

Voluntary Benefit Plans / Voya

Hospital, Accident, Critical Illness

No changes to coverage or rates for 2026

As a supplement to the protection that the medical and disability plans provide, you have the opportunity to enroll in supplemental medical benefits for additional coverage. These supplemental medical benefits will pay cash benefits for covered illnesses, hospital stays, or injuries.

You do not have to be enrolled in the Maritz medical plan in order to be eligible for the Hospital Confinement, Accident, or Critical Illness plans.

Your spouse and unmarried children up to age 26 are eligible if you are also enrolled.

The plans are portable and can be taken with you if you ever leave Maritz.

There are no health questions or physical exams required to purchase coverage. Each benefit is payable upon diagnosis of a covered condition that occurs after the coverage effective date. Pre-existing conditions are covered; however, for the Critical Illness plan, if the diagnosis of a covered condition occurring after the coverage effective date is a subsequent diagnosis of a condition that occurred previously, a diagnosis-free period of 12 months must be satisfied between diagnoses.

Each plan pays a benefit, regardless of any benefits you receive from other insurance programs. The benefits will be paid directly to you, and you may use the money to pay for out-of-pocket medical expenses, transportation expenses, mortgage payments, tuition expenses, household expenses, hiring outside help, or however you like.

Depending on the additional level of protection you would like, you can enroll in one, two, or all three of these supplemental medical options. If you enroll in more than one, it is possible to receive benefits from multiple plans for the same accident or illness. For example, if you enroll in the Accident and Hospital plans, then you could receive a benefit from both plans in addition to the benefits you would receive under your medical plan, if you have an accident that requires inpatient hospitalization and is also an injury covered by the Accident plan. The same would apply if you are enrolled in the Critical Illness and Hospital plans in addition to your medical plan. If you have an illness that is covered under the Critical Illness plan which also requires inpatient hospitalization, you would receive benefits from both the Critical Illness and Hospital plans in addition to the benefits paid by your medical plan.

Below is a summary description for each plan. For a detailed listing of covered benefits and costs, visit Voya’s website, then click on Learn More. There are also links to Real Life examples, FAQs, and short videos to give you additional information about these benefits.

Accident Plan

The Accident Plan pays a benefit for specific injuries resulting from a covered accident that occurs while you are not at work, if the accident occurs on or after your coverage effective date. The benefit amount depends on the type of injury and care received. Common injuries covered are burns; emergency dental work; eye injury; torn cartilage or tendons, ligaments, or rotator cuff; concussion; paralysis; joint dislocations; and fractures. You may be required to seek care for your injury within a set amount of time.

Examples of Benefits Paid

Hospital Admission - $750

Coma lasting 14 days or more - $8,500

Urgent Care Facility Treatment - $150

Initial Doctor Visit - $60

Torn Knee Cartilage, Surgical Repair - $400

Leg Fracture - $1,200 if no surgery or $2,400 if surgery required

Semi-monthly Cost - Accident

Employee Only $3.56

Employee + Spouse $6.13

Employee + Children $7.01

Employee + Family $9.58

Critical Illness Plan

The Critical Illness Plan pays a lump-sum benefit upon diagnosis of a heart attack, stroke, cancer, or major organ transplant:

$10,000 for you or your covered spouse

$ 5,000 for a covered child

25% for Coronary Bypass or Carcinoma in situ

10% paid for skin cancer

Semi-Monthly Cost - Critical Illness

Rates are based on the employee’s age for the employee and for spouse coverage. Cost ranges from $2.10 if you are less than 25 years old to $31.30 if you are age 70 or older. The cost for child coverage is $.40 per pay period.

Your cost will be calculated and displayed in Workday when selecting the coverage. For a complete list of rates for all age bands for employee or spouse coverage, go to the Voya website then click on Learn More.

Hospital Confinement Plan

The Hospital Confinement Indemnity Plan pays a benefit for each day of inpatient hospitalization as follows:

$500 Hospital Admission Day One

$100 Confinement Daily Benefit

Up to maximum of 30 days

$300 ICU Confinement Daily Benefit

Up to maximum of 15 days

There is a combined confinement maximum benefit of 30 days, regardless of admission type (ICU or non-ICU).

Re-confinements that occur within 14 days after being discharged for the same or a related condition are considered as a continuation of the previous confinement.

The $500 Hospital Admission/Initial Confinement benefit is payable only once per calendar year per covered member, up to a maximum of 4 Initial Confinement benefits for all covered members.

Please Note:

If you are enrolled in the Hospital Confinement Indemnity plan with Employee+Children or Employee+Family coverage and then deliver a baby during the calendar year, you will be eligible to receive a benefit for each day the baby is hospitalized in addition to the benefit you will receive for your own hospitalization, but you will need to file two claims – one for yourself and one for your baby. However, if this baby is your first child and, therefore, you are only enrolled in Employee Only or Employee+Spouse coverage at the time of delivery, you will only be eligible to receive a benefit for the mother’s hospitalization if she is covered on the plan on the day of delivery.

Semi-monthly Cost - Hospital

Employee Only $ 4.98

Employee + Spouse $10.33

Employee + Children $ 7.80

Employee + Family $13.15

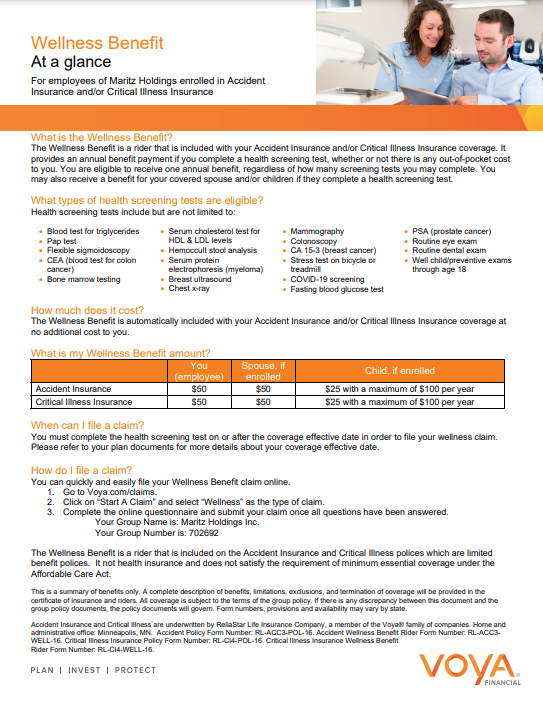

Wellness Benefit Rider

The Accident and Critical Illness Plans each have an annual $50 Wellness Screening benefit which will pay upon completion of a wellness health screening test for you and/or your covered spouse. Covered children are eligible for 50% of your benefit amount, up to $100 maximum for all children per year. This wellness benefit is paid directly to you unless otherwise specified. A wellness benefit is limited to one annual payment per policy year per covered person.

Examples of eligible health screenings can include a routine dental exam, routine eye exam, preventive colonoscopy or mammogram, biometric screening, or well-child preventive exams through ages 1-18. The physical examination provision does not apply to this rider.

Claims should be submitted within the same calendar year in which the health screening occurs, preferably within 90 days after the date of the health screening test, but no later than 30 days after the end of the calendar year.

Click here to see a list of additional eligible health screenings and information regarding how to file your claim to receive your wellness benefit.